COUNCIL TAX

To be blunt - COUNCIL TAX IS FRAUDULENT!

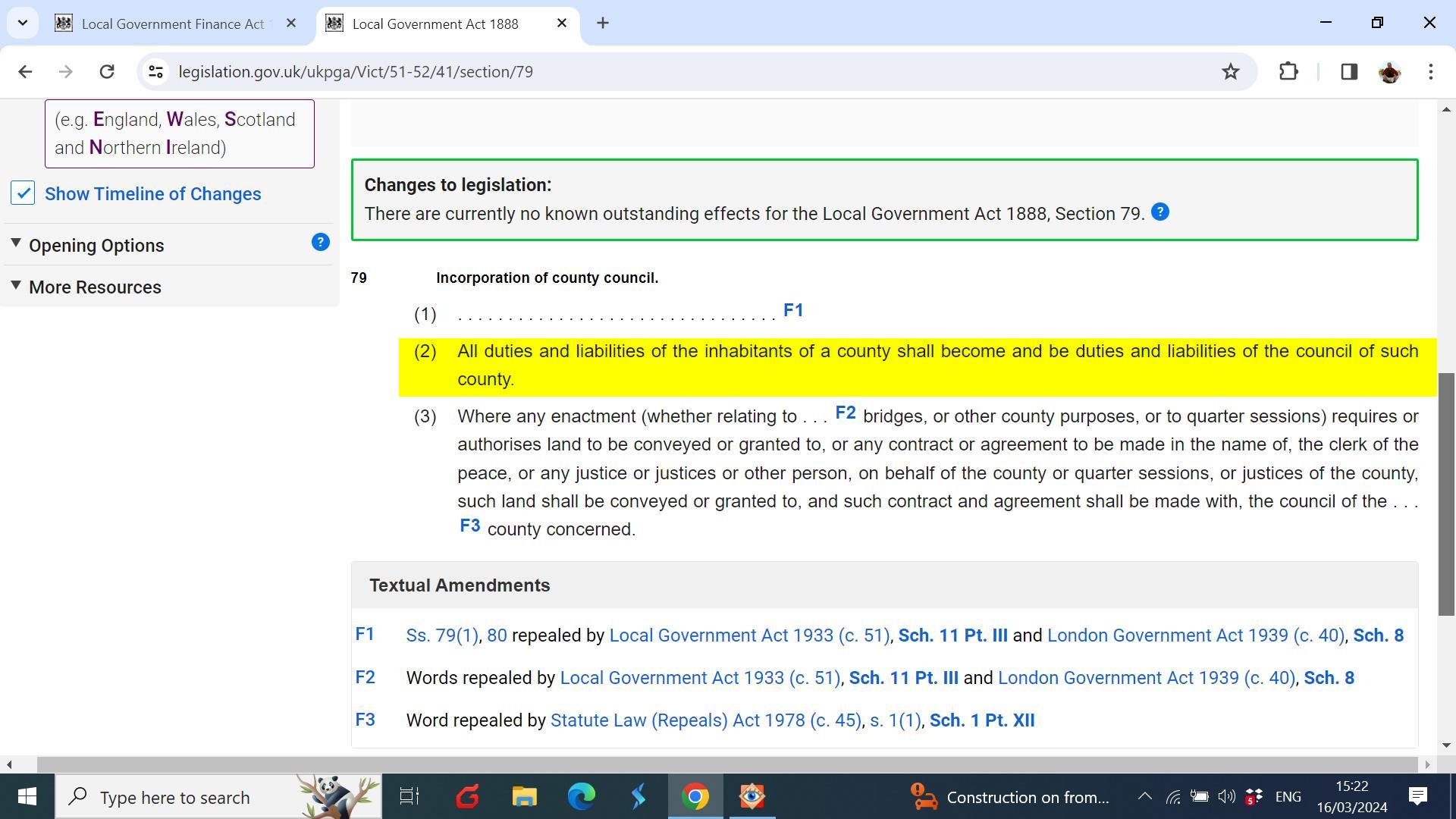

"All duties and liabilities of the inhabitants of a county shall become and be duties

and liabilities of the council of such county."

- Local Govt Act 1888 s.79 Incorporation of county council. Point (2)

THIS IS STILL PERTINENT TODAY AND CAN BE FOUND ON THE GOVERNMENT WEBSITE. WHY WEREN'T WE TOLD?

No matter what you are told by your Local Authority the truth of the matter is that Council Tax is Fraudulent.

Of course the Local Council will tell you different in order to cover their backsides and they will lie to your face. But let's put this in perspective. Many staff, even within the revenue collection department probably don't even know, but their bosses do indeed know!

The Council tries to baffle and confuse the public by quoting reference to the 1992 Local Government Finance Act which allows them the right to claim tax, which is, technically, true. However, although Councils are obligated to 'request' payment, nowhere does the law specify any obligation for any inhabitants to pay it. This makes Council tax 'voluntary' to pay with the only compulsory aspect being that the Council must set a budget each year and 'request' payment of it.

Instead, though. the Councils have fooled the public into believing that they have an obligation to pay and have then used the full force of the law to back their lies. This has since evolved into a process of racketeering and collusion with central government and the Courts which makes the Italian mafia look like amateurs. Councils continue to do this is the full knowledge that they are breaking the Law and committing Fraud.

IT IS IMPORTANT TO UNDERSTAND

Nobody is claiming we have no responsibility to pay for, and manage, our local services or that financially

contributing to it is a bad idea. What we object to, though, is the criminal enterprise it has become over the past

thirty years following the introduction of Council Tax, that has handed over all of the previously local power to

central government, which has given itself the right to spend our money in any way it chooses.

Local funding is a justifiable, moderate and fair way to fund local services, but today it is neither fair, moderate nor local. Monies collected from Council Tax is paid into a central Treasury account (The Consolidated Fund) from which government can allocate it to fund anything it deems appropriate including, wars, weapons and unaccountable NGOs.

Still Don't Believe Your Government Is Corrupt?

There's much more to explore....

Could it be that the Council is flouting commercial law?

Do your Council Tax payments, which you have been making, even go directly to the Council?

Is the Council Tax bill you receive at the beginning of April even legal?

Do the Summons the Council threatens you with, even stand up to scrutiny?

Does your home even qualify for Council Tax?

How do the legal definitions affect your status to pay?

How does paying Council Tax fit in with funding wars?

How do you counter the barrage of authoritarian correspondence from your Local Authority?

Is there a way to counter the Local Authority's demands from a legal perspective without the stress?

The above are just some of the questions you'll be asking yourselves as you contemplate the

information we've provided, and whilst the questions are very valid, and the answers are readily available,

for obvious reasons we will not publish the solutions within the site. We'd recommend that you

attend our regular meetings or write to us via the contact page with your specific questions, and

we'll try our best to answer or point you in the right direction.

USEFUL RESOURCES